📈 Early Signs of Strength, but a Tricky Week Ahead for Traders

Markets are flashing early signs of strength, but traders should prepare for a challenging week ahead. ⚡

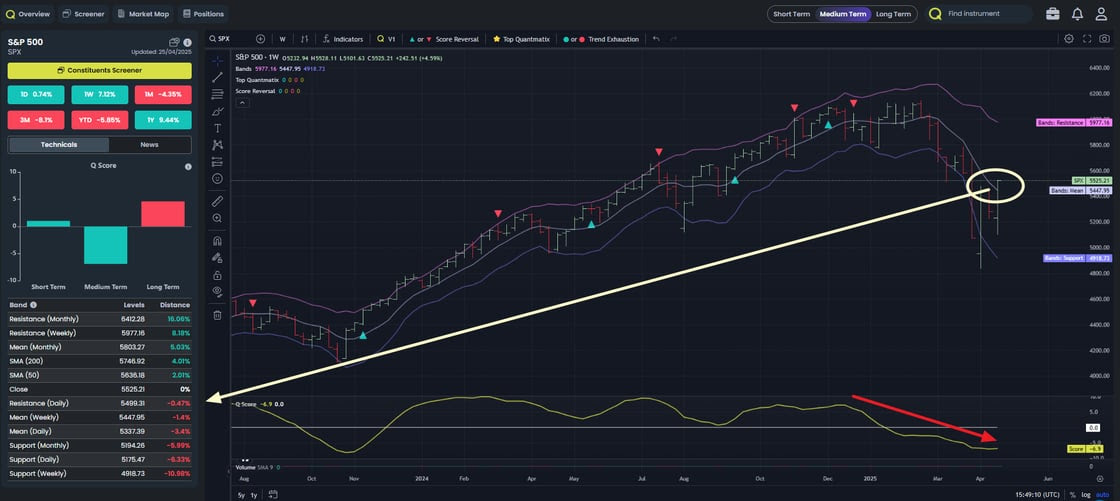

✅ Quantmatix confirmed a Weekly Positive Cluster of Signals, with over 1,000 Weekly Positive Signals generated — a strong indication of improving sentiment.

Key Highlights:

Significant Positive Signals emerged in the Russell 2000 futures, US Sector ETFs, and the Mag 7 ETF — the first time since January 6.

However, there are no Weekly Positive Signals yet in the S&P 500, Nasdaq, or major European indices. ⚠️

📊 While Quantmatix Regime Scores remain negative, the cluster of Weekly Signals suggests the earliest signs of a potential market inflection.

This follows the >3,000 Daily Positive Signals flagged last week, further supporting the shift.

⚠️ Near-Term Caution is Warranted

Despite these promising developments, short-term trading conditions could be volatile:

Many stocks are now overbought.

Mega Cap tech earnings — including Apple 🍎, Microsoft 💻, Amazon 📦, and Meta 📱 — will add to market volatility this week.

Tariff uncertainty remains an overhang on risk appetite.

After a strong +4% gain last week, markets are currently approaching a critical resistance zone formed by the Daily Top Band and the Weekly Centre Band.

🔵 The conjunction of these two bands creates a significant technical barrier that must be breached and held to sustain further upside.

🧭 What to Watch:

A potential -3% pullback in the S&P to retest the Daily Centre lin

e before any sustainable move higher.

Elevated short-term volatility around earnings and macro headlines.

📝 Final Thoughts

There are genuine early indications of a positive turn in market sentiment. However, near-term risks are elevated, and this week could be particularly challenging to navigate.

Traders should stay alert, disciplined, and responsive to emerging signals.